Πριν από έναν χρόνο, οι επιχειρήσεις — και ιδιαίτερα οι διευθύνοντες σύμβουλοι — ήταν αισιόδοξες για την αμερικανική οικονομία το 2025, προσδοκώντας χαμηλότερους φόρους και πιο φιλικές προς την αγορά πολιτικές από τον νεοεκλεγμένο πρόεδρο Ντόναλντ Τραμπ. Έπειτα ήρθε η 2α Απριλίου, η “Ημέρα Απελευθέρωσης”. Η αγορά έπεσε, η αβεβαιότητα αυξήθηκε και η προσιτότητα του κόστους ζωής έγινε πιο έντονη ανησυχία. Παράλληλα, η αγορά εργασίας συνέχισε να αποδυναμώνεται, καθώς οι περιορισμοί στη μετανάστευση οδήγησαν σε βραδύτερη αύξηση του εργατικού δυναμικού και σε ελλείψεις εργατικών χεριών σε ορισμένους τομείς.

Παρόλα αυτά, η αμερικανική οικονομία άντεξε. Καθώς πλησιάζει το τέλος του έτους, η αγορά έχει ανέβει πάνω από 15%, και η ανάπτυξη του ΑΕΠ στο τρίτο τρίμηνο ήταν απροσδόκητα ισχυρή, στο 4,3%. Πώς θα είναι το 2026; Υπάρχουν λόγοι για αισιοδοξία, όπως υπήρχαν και πριν από έναν χρόνο. Ορίστε πέντε από αυτούς.

Οι καταναλωτές θα έχουν περισσότερα χρήματα. Ο υπουργός Οικονομικών Σκοτ Μπέσεντ δήλωσε ότι αναμένει οι Αμερικανοί να λάβουν έως και 150 δισ. δολάρια σε επιστροφές φόρων στις αρχές του επόμενου έτους ως αποτέλεσμα του νόμου για τον προϋπολογισμό που υπέγραψε ο πρόεδρος το περασμένο καλοκαίρι. Τα υψηλότερα εισοδήματα, που ξοδεύουν μικρότερο ποσοστό του εισοδήματός τους, θα αισθανθούν μεγαλύτερο αντίκτυπο, με αξιοσημείωτη εξαίρεση όσους έχουν εισόδημα από φιλοδωρήματα. Παρόλα αυτά, το Γραφείο Προϋπολογισμού του Κογκρέσου αναμένει ότι οι φορολογικές περικοπές θα ενισχύσουν τη ζήτηση και την προσφορά εργασίας το επόμενο έτος. Ο Τραμπ λέει επίσης ότι θα στείλει επιταγές ύψους 2.000 δολαρίων στα περισσότερα νοικοκυριά το επόμενο έτος για να κατευνάσει τις ανησυχίες σχετικά με το κόστος ζωής. Αυτό καλό είναι να αντιμετωπιστεί με επιφύλαξη, αλλά η συνολική κατεύθυνση της φορολογικής πολιτικής είναι προς περισσότερη κατανάλωση και μεγαλύτερη εμπιστοσύνη για τους καταναλωτές.

Οι επιχειρήσεις θα έχουν περισσότερα χρήματα. Άλλη μία διάταξη του νόμου για τον προϋπολογισμό είναι ότι οι εταιρείες μπορούν να αφαιρούν ως δαπάνη το 100% των αγορών εξοπλισμού στο έτος που πραγματοποιούνται. Υπάρχουν ενδείξεις ότι ένας παρόμοιος κανόνας, καθώς και οι φορολογικές περικοπές για τις επιχειρήσεις, ενίσχυσαν τις επενδύσεις κατά 11% και το ΑΕΠ κατά σχεδόν 1% μετά την ψήφιση του φορολογικού νόμου του 2017. Όμως το ποσοστό των δαπανών που οι εταιρείες επιτρεπόταν να αφαιρούν μειωνόταν από τότε που ψηφίστηκε ο αρχικός νόμος και υπήρχε αβεβαιότητα για το ποιο θα ήταν στο μέλλον. Η νέα διάταξη αναμένεται να αυξήσει τις επενδύσεις σε πάγιο κεφάλαιο και την ανάπτυξη το επόμενο έτος και πέραν αυτού.

Τα επιτόκια θα είναι χαμηλότερα. Είναι αβέβαιο αν ο πρόεδρος της Fed Τζερόμ Πάουελ θα προχωρήσει σε περαιτέρω μειώσεις, αλλά ο νέος πρόεδρος της Fed που θα αναλάβει τον Μάιο σχεδόν σίγουρα θα το κάνει. Είναι επίσης πιθανό ότι η τράπεζα θα αυξήσει τις αγορές κρατικού χρέους, χαλαρώνοντας περαιτέρω τις συνθήκες χρηματοδότησης.

Η ενέργεια θα μπορούσε να είναι φθηνότερη. Το Γραφείο Προϋπολογισμού του Κογκρέσου προβλέπει ότι οι φορολογικές διατάξεις που ενθαρρύνουν την αυξημένη παραγωγή πετρελαίου και φυσικού αερίου θα έχουν επίσης θετική επίδραση στο ΑΕΠ του επόμενου έτους. Εκτιμά ότι ο αντίκτυπος θα είναι μεγαλύτερος τα επόμενα χρόνια, επειδή ορισμένοι από τους κανονισμούς είναι προσωρινοί, αλλά δεν είναι απίθανο μια μεγαλύτερη προσφορά ενέργειας να μειώσει το κόστος της.

Θα υπάρξει περισσότερη σιγουριά γύρω από τους δασμούς. Ίσως αυτό να είναι ο θρίαμβος της ελπίδας έναντι της εμπειρίας. Από την άλλη πλευρά, θα είναι δύσκολο να υπάρξει λιγότερη σταθερότητα πολιτικής από όση υπήρξε φέτος. Το υψηλό επίπεδο δασμών που ανακοινώθηκε την “Ημέρα Απελευθέρωσης” όχι μόνο σόκαρε τις αγορές, αλλά η συνεχής αβεβαιότητα σχετικά με το ποιοι θα είναι και σε τι θα εφαρμόζονται προκάλεσε οικονομική ζημιά και πιθανότατα συνέβαλε σε υψηλότερο πληθωρισμό. Τώρα οι συμφωνίες τίθενται σε ισχύ και το ζήτημα της νομιμότητας θα επιλυθεί με τον έναν ή τον άλλον τρόπο.

Αν τα προσθέσει κανείς όλα αυτά, υπάρχουν λόγοι να είναι αισιόδοξος για το 2026. Ο αντίκτυπος μόνο του νόμου για τον προϋπολογισμό αναμένεται να ενισχύσει το ΑΕΠ του επόμενου έτους κατά 0,9%.

Πέρα από το 2026, υπάρχουν λόγοι ανησυχίας: όλη αυτή η τόνωση της οικονομίας μπορεί να οδηγήσει σε ένα πρόσκαιρο “σάκχαρο”, και η Αμερική έμαθε ξανά κατά την πανδημία πόσο επικίνδυνο μπορεί να είναι αυτό. Οι επιταγές επιστροφής χρημάτων, μια φορολογική περικοπή και τα χαμηλότερα επιτόκια ενέχουν τον κίνδυνο να επαναφέρουν τον υψηλό πληθωρισμό, ο οποίος θα έπληττε σκληρά τα αμερικανικά νοικοκυριά και θα μπορούσε να παγιώσει περαιτέρω τον πληθωρισμό αποσταθεροποιώντας τις προσδοκίες. Θα μπορούσαν να χρειαστούν χρόνια για να ανακτήσει η Fed την αξιοπιστία της και την ικανότητά της να επηρεάζει τον ρυθμό του πληθωρισμού. Υπάρχει επίσης το ζήτημα του αυξανόμενου εθνικού χρέους, στο οποίο θα συμβάλει αυτός ο νόμος. Αυτό θα αυξήσει τα μακροπρόθεσμα επιτόκια, τα οποία θα μπορούσαν τελικά να επιβαρύνουν τις καταναλωτικές δαπάνες.

Αλλά αυτά είναι προβλήματα για κάποια άλλη χρονιά — και για κάποια άλλη στήλη.

Five Reasons for Optimism About the Economy in 2026

A year ago, businesses – and especially CEOs – were optimistic about the US economy in 2025, expecting lower taxes and more market-friendly policies from the newly elected President Donald Trump. Then came April 2nd, “Liberation Day”. The market fell, uncertainty increased, and the affordability of living became a more acute concern. At the same time, the labor market continued to weaken as immigration restrictions led to slower labor force growth and labor shortages in some sectors. However, the US economy persevered. As the end of the year approaches, the market has risen by more than 15%, and GDP growth in the third quarter was unexpectedly strong, at 4.3%. What will 2026 be like? There are reasons for optimism, just as there were a year ago. Here are five of them. Consumers will have more money. Treasury Secretary Scott Besent says he expects Americans to receive up to $150 billion in tax refunds early next year as a result of the budget law signed by the President last summer. Higher earners, who spend a smaller percentage of their income, will feel a greater impact, with a notable exception for those earning income from tips. However, the Congressional Budget Office expects the tax cuts to boost demand and labor supply next year. Businesses will have more money. Another provision of the budget law is that companies can deduct 100% of equipment purchases as an expense in the year they are made. There is evidence that a similar rule, as well as tax cuts for businesses, boosted investment by 11% and GDP by almost 1% after the passage of the 2017 tax law. But the percentage of expenses companies were allowed to deduct has been declining since the original law was passed and there was uncertainty about what it would be in the future. The new provision is expected to increase investment in fixed capital and growth next year and beyond. Interest rates will be lower. It is uncertain whether the Fed chairman Jerome Powell will proceed with further cuts, but the new Fed chairman who will take office in May will almost certainly do so. It is also likely that the bank will increase its purchases of government debt, further easing financing conditions. Energy could be cheaper. The Office of Budget…

You Might Also Like

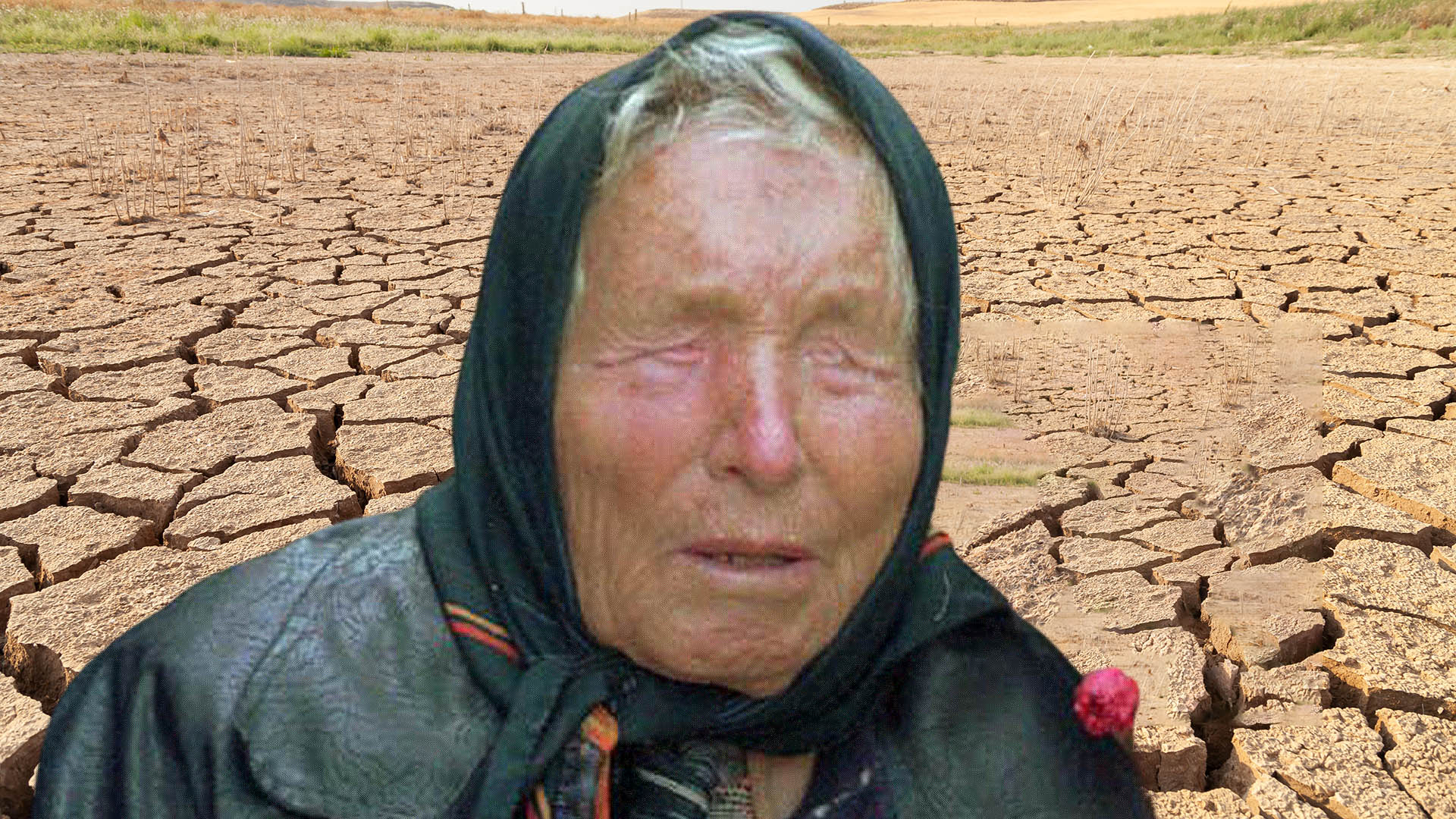

Οι «προβλέψεις» της τυφλής μάντισσας για το 2026: Προειδοποιεί για την AI

Dec 17

Γιατί η φούσκα ΑΙ θα συνεχίσει να διογκώνεται το 2026 και θα σκάσει το 2027

Dec 18

Πως θα διαμορφωθεί η παγκόσμια «σκακιέρα» το 2026

Dec 24

Η Τεχνητή Νοημοσύνη το 2026: Τα διλλήματα, οι επενδύσεις και το τι θα γίνει αν σκάσει η… «φούσκα»

Dec 28

Wall Street: Bullish για τις μετοχές το 2026 – Ας υποθέσουμε ότι κάνει λάθος

Dec 30